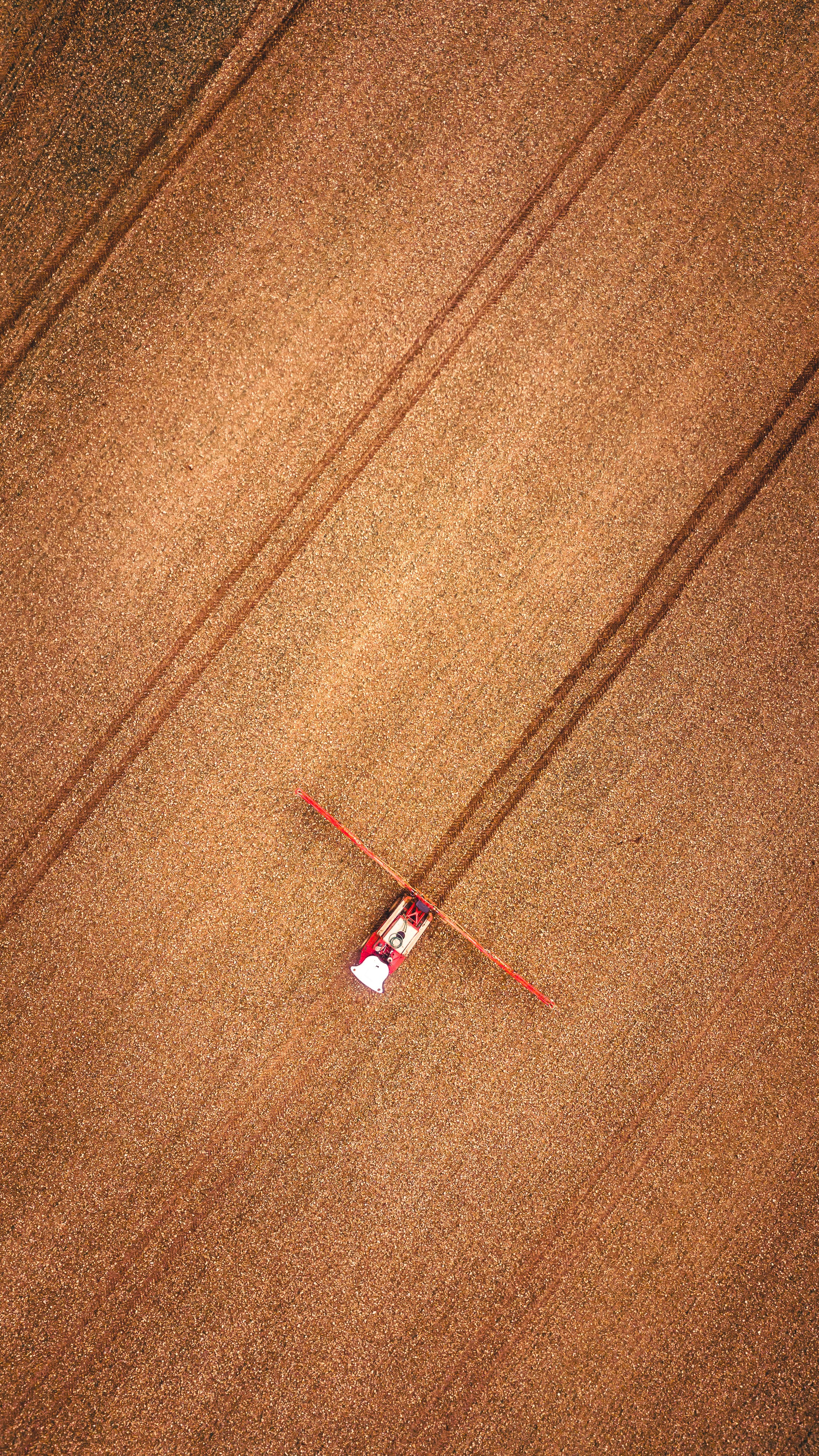

EarthOptics is a soil mapping company. It creates a digital twin of the soil so that all stakeholders, from farmers to consumers, can make better decisions about how we grow and consume food.

The soil that covers our planet is the 2nd largest carbon sink after the ocean, yet only 1% of all carbon credits come from agriculture. Importantly, soil health improves with more carbon, unlike the ocean, which acidifies and becomes more hostile to life with more carbon. As a result, getting the soil to absorb more CO2 from the atmosphere is not only good for reversing global warming, it is also a strong lever for farmers to improve their economics.

With the advent of soil carbon credits, farmers can get compensated for farming practices that increase the level of carbon in their fields while reaping the benefit of increased soil health and therefore better yields. However, cheap and accurate soil carbon measurement, reporting, and verification (MRV) has been the limiting factor for soil carbon credit growth. EarthOptics makes MRV accurate, scalable, and appropriately priced, allowing millions of acres of farmland to tap into the carbon marketplace. Conversely, carbon offset buyers can finally get the data they need to purchase soil carbon credits with confidence. Solving MRV unlocks latency on both the supply and demand sides of the voluntary carbon marketplace, but too few companies have focused on this key step.

EarthOptics is the first company to solve soil quantification at scale thanks to the accuracy of its measurement platform.

Applied Carbon turns agricultural waste into a carbon sequestering powerhouse called biochar. The company’s systems go into the field and turn biomass into biochar in real time, on the go.

The way biochar is produced today makes it prohibitively expensive: close to 100% of biochar is made in centralized facilities that procure wood waste from biomass power plants. The transportation of lightweight wood waste to these facilities, followed by the transportation of lightweight biochar from these facilities to farms, means that transportation represents up to 50% of the cost of biochar delivered to a farm today. In addition, manufacturing biochar at a consistent quality is a challenge, and the heterogeneity in quality makes it difficult to scale because standardized quality is important for large-scale farmer adoption.

We invested in Applied Carbon because it is the first company to solve all of these issues at once. Its innovation to produce high-quality biochar from ag waste on-site, continuously, in real-time and tailored to a farm’s specific soil characteristics is a solution that solves the fundamental flaws of price and quality in the biochar market.

OCO converts CO2 into organic chemicals.

The majority of the world’s chemicals are produced thermochemically from fossil fuel-derived feedstocks, contributing to approximately 5% of global greenhouse gas emissions. Electrochemistry offers a different process, whereby electricity replaces industrial heat as the energy driving a chemical reaction. The multi-decade drop in renewable power prices has finally made the concept of ‘Power-to-X’ economically competitive, allowing us to produce certain chemicals in a carbon-neutral way. In addition to eliminating the need for industrial heat (and avoiding its associated emissions), we can also use CO2 instead of natural gas or coal as the carbon feedstock, turning greenhouse gas emissions into valuable chemicals.

Because CO2 is a very stable molecule and requires a lot of energy to transform, there are only a few chemicals today that make economic sense to be produced electrochemically from it. These are mostly C1 chemicals that don’t require more than a few electrons to produce the target molecule. To date, most companies have focused on carbon monoxide (CO) because it is a precursor molecule to many large end-markets. Potassium formate, however, is the only liquid chemical that can be produced electrochemically from CO2 in a two electron process.

Unlike CO, it is a liquid organic hydrogen carrier (LOHC). And unlike other LOHCs, such as ammonia or methanol, it is non-corrosive, non-explosive, and therefore much easier to transport. It is also the only one that can be produced competitively with fossil fuels today. Because of these factors, it is our view that potassium formate and its downstream chemicals, whose markets total hundreds of billions of dollars, will play an important role in the global movement of energy. OCO is the only company working on the formate complex, and it is leading the charge in CO2 electrolysis, having recently commissioned the largest CO2 electrolyzer in the world.

Superbrewed produces a first-of-its-kind ingredient complex that combines protein, vitamins, minerals, and gut-enhancing fatty acids.

Food and beverage CPG is one the largest markets in the U.S. and is undergoing a major structural shift driven by increasing regulation and changing consumer behavior. Regulators are banning unsupported marketing claims, and consumers are increasingly making purchasing decisions based on health outcomes. In particular, demand for protein has posed a difficult challenge for CPGs: consumers want much more of it, but animal-derived protein comes with a variety of risks, and plant-based protein performs poorly in packaged goods.

Microbial proteins are the perfect solution for increasing protein content without compromising on taste, nutrition, or price.

Superbrewed has identified the perfect organism to deliver. It is a rich source of protein (85% by dry weight) and has high levels of important vitamins and minerals, making it not just a great source of protein but also a great source of nutrition. Importantly for Superbrewed’s customers, the product has a baseline sensory profile, which makes it an easy ingredient to formulate with that doesn’t adversely affect a product’s taste profile. Additionally, the protein’s natural encapsulation within the organism cell means that it doesn’t interact with other ingredients within a formulation, making it easy to physically integrate into a recipe.

Together, these characteristics offer food and beverage customers the ability to replace animal protein, emulsifiers, and micronutrient packs in their formulations, delivering a cheaper, better product with a shorter, cleaner ingredients label without having to change their brand guidelines. It also allows them to make backable marketing claims around health and carbon neutrality.

Production is also inherently easier than other protein platforms. The rapid bacterial growth rates, feedstock flexibility, and high protein, mineral, and vitamin levels create three core advantages: First, this segment can reach cost levels at scale that only the cheapest plant proteins can reach, yet with far superior functionality. Second, manufacturing scale-up could be much easier than other biotech solutions given the simplicity of the fermentation process for most organisms. Third, the production of fermentation co-products offers multiple revenue streams that add to the bottom line.

The ability to offer a no-compromise product from a highly scalable technology is unique to Superbrewed and is what compelled us to back this incredible company.

Universal Fuel Technologies converts a variety of low-value, renewable feedstocks into high-value, drop-in sustainable aviation fuel (SAF) and chemical by-products.

Aviation is responsible for 2% of global greenhouse gas emissions (GHGs) and is the fastest-growing source of GHGs, averaging more than 4% annual growth as people in the developed world travel more often and people in the developing world begin to travel. A record 4.7B passengers to travel by plane in 2024. And yet, only approximately 10% of the world population has ever taken a plane. As the world economy develops, it is expected that 10B passengers will fly every year by 2050, accounting for a 50% increase in jet fuel consumption, to 520M tons per year in 2050.

Sustainable Aviation Fuel is widely expected to replace most, if not all, of fossil kerosene by 2050, a $500-600B potential market. It is produced by numerous technology pathways that are dependent on numerous different renewable feedstocks that have varying levels of carbon intensity and therefore have varying levels of compliance- and tax credit- eligibility.

In addition, given that it is a drop-in replacement to kerosene fuel at the same time as it is a biofuel (with the exception of e-SAF, which is produced from renewable energy and green hydrogen), the space is seeing huge interest from incumbents spanning the spectrums of scale and industry, from massive oil refiners looking to decarbonize to family-owned ethanol producers seeking new opportunities to counter-balance falling gasoline consumption. As a result, it is an incredibly complex and dynamic market that offers no clarity in terms of who the winners will be.

UFT hovers above this as a technology provider that is feedstock- and scale- flexible.Through its technology, UFT offers a unique value proposition in each technical pathway that solves an acute problem that is experienced in that pathway, in addition to valuable sidestream chemicals. The ability to play in all SAF pathways with a unique value proposition and low technology risk convinced us that UFT will be the first company to index the SAF market.

Enzinc manufactures zinc-based battery components that unlock unparalleled energy density and cycle life.

As global demand for energy storage skyrockets, the world needs to scale up the production of batteries at record speed. The solution lies in an untapped resource: the 400 GWh of manufacturing capacity in the lead-acid battery space. These factories of old technology can be transformed into powerhouses for advanced batteries—without the massive capital investment required to build new lithium-ion factories.

Enzinc unlocks this potential. Its groundbreaking technology empowers existing battery brands to produce advanced nickel-zinc (NiZn) batteries, tripling their effective output while boosting revenue and margins. By partnering with Enzinc, legacy battery manufacturers leverage their existing capital equipment and continue competing for decades, leveraging their domestic supply chains and existing brands for a significant ROIC. For the first time, the U.S. can onshore the production of high-performance batteries using domestic supply chains and abundant U.S. zinc resources that rival lithium-iron phosphate (LFP), all without the fire risks and environmental concerns.

Thanks to Enzinc’s proprietary zinc micro-sponge anode, zinc can be used in a high-performance battery that offers both high energy density, power output, and unparalleled safety for the first time. What this means is that there is finally a battery that breaks the age-old trade-off between price, performance, and safety. Enzinc’s leadership in zinc battery chemistry, in addition to its potential to unlock massive latent supply to position the U.S. as a leader in advanced battery manufacturing, is what convinced us to make our first battery investment in Enzinc.

Ferveret has developed a unique chip cooling solution for crypto mining data centers and traditional cloud- or AI-based high performance computing data centers.

Ferveret’s two-phase immersion cooling far outperforms air cooling and existing liquid cooling solutions. Their subcooled nucleate boiling has the highest heat transfer properties on the market and therefore delivers superior heat removal that can double chip performance while reducing the risk of chip failure associated with overheating, allowing for significant overclocking capabilities by up to 100%. Ferveret’s rack-mounted form factor allows integration with existing and new data center infrastructure with design that improves power density by at least 65%, resulting in better floor planning and smaller data center footprints. This drives the company’s key value propositions, of design, performance and cost savings.

Ferveret has developed its system at an opportune moment; capital spending on procurement and installation of mechanical and electrical systems for data centers is expected to surpass $250B by 2030. Given that cooling accounts for 40% of data center energy consumption, data center operators and developers are exploring advanced cooling technology to improve their operational efficiency, reduce power requirements for cooling and utilize that power to meet computational demand. Ferveret’s technology and convenient form factor are what will give it a leadership position in this space.

Telo is building the first ever compact EV pickup truck.

The automotive market is experiencing a fundamental shift toward smaller, more manageable vehicles driven by parkability, affordability, and efficiency considerations. This is particularly true for urban commercial fleets, such as mid-mile and last mile delivery partners. Telo’s MT1 is the first fully street-legal vehicle designed from the ground up for urban environments that maintains complete pickup truck capabilities.

Thanks to unique battery and safety architectures, the MT1 is able to fit the performance of a full-size pickup truck (bed size, hauling, and towing capacity) in the footprint of a 2-door Mini Cooper, making it the only American pickup truck that stays true to the ‘small pickup truck’ category name. We invested in Telo because this is a team that is obsessed with delivering a no-compromise solution to its customers, and they will stop at nothing to get it done.

Element3 is turning wastewater into an immediately available, abundant, and domestic resource for lithium production.

The U.S. is doing a good job of building domestic battery manufacturing plants but it will never truly onshore lithium-ion battery manufacturing until it secures the entire supply chain, starting with the raw materials. Every year, the U.S. produces 1 trillion gallons of wastewater from the oil and gas industry. This water is normally disposed of, despite it having economic concentrations of certain minerals, including lithium. Recently, it has started to be recycled for more oil and gas production, making it clean enough to put through certain technologies for mineral extraction. Element3’s technology is unique in extracting lithium economically from produced water, which is a sub-optimal resource with high barriers to entry.

It is, however, a resource that is plentiful and immediately available. What this does is that it turns a major liability into a massive asset, positioning the U.S. to fully onshore its lithium-ion supply chain. We invested in the Element3 team because they see opportunity where others see waste and they build robust partnerships where others see misalignment. When Element3 succeeds at scaling up, it will become a top 5 U.S. producer in record time with a fraction of the capital that others in this space require.

Founded in 2022, TO VC has evolved from to.org/Ventures, a firm that focused its investments on food and energy systems, as well as high-growth and high-impact startups on the African continent.

Joshua’s mission is to find breakthrough solutions that redesign the fundamental systems that support human life—energy and food—so that they can unlock abundance within planetary boundaries.

Before founding TO VC, Joshua had a career in agribusiness, where his experience gave him insight into the negative externalities that come from extractive food and energy systems.

From 2013 to 2017, he held positions at Archer Daniels Midland that included freight trading, grain origination and marketing, and wheat trading in the United States, South America, South Africa, and Switzerland. In 2017, he became a managing partner at Alliance Commodities, a leading rice trading firm specializing in West African trade flows with South America and Asia. In 2019, he became a Managing Partner at to.org/Ventures, leading the firm’s food & agriculture strategy.

Since 2017, he has worked with to.org and Groupe Mimran to build an investment and philanthropic program that deploys resources in regenerative agriculture, improved food production, and natural habitat restoration in West Africa.

Arieh dedicates himself to using finance as a force for good. He believes that capitalism can be creatively directed to solve the world’s greatest challenges to deliver outsized financial returns. Before founding TO VC, Arieh served as Chief Investment Officer of to.org, which he co-founded in 2015, directing its investment strategy and working closely with portfolio companies across food systems, energy systems, climate technology, Africa, generalist portfolios, and other high-growth sectors globally.

He holds a Bachelor of Arts in Sociology from Princeton University, where he conducted novel sociological studies on finance, elites, and inequality. He is an adviser to foundations, family businesses, and family offices, designing governance systems that facilitate stakeholder alignment. He co-founded the University of Zurich’s Center for Sustainable Finance and Private Wealth, and is a course Design Team member at the MIT Sloan School of Management.

Arieh built the Groupe Mimran family office and investment program, replicating similar structures for other large family businesses. As Chief Investment Officer of the Groupe, he directs investment strategy and oversees allocations across the global portfolio of operating companies and diversified endowment-style portfolios. Arieh serves on the boards and investment committees of numerous family business entities and their associated investment offices.

Howard has been involved with sustainable agricultural and agroforestry systems, plant breeding, molecular biology and genomics for over 50 years.

He has advised indigenous communities, non-governmental organizations, governmental agencies, and private institutions worldwide, including several national and regional agricultural, biotech, and agroforestry institutions.

Howard’s academic career spans 45 years. Currently a Senior Fellow at UC Davis College of Agriculture and Environmental Sciences, he served for 20 years as the Chief Agricultural Officer at Mars, Inc. He was a member of the National Research Council Committee on Citrus Greening, Chairperson of the Board of the Agriculture Sustainability Institute at UC Davis and the recipient of The Award of Distinction from The College of Agriculture and Environmental Sciences, UC Davis. He is the recipient of the University of California Lifetime Achievement in Innovation Award.

Charles is passionate about building businesses with impact, helping companies navigate the startup journey and working with entrepreneurs who are driven to change the world they know.

Prior to joining TO VC, Charles managed the Enterprise Technology portfolio at Point72 Ventures and is currently an Advisor to Global Predictions and BlockApps as well as a member of the Board of Melior Innovations. He brings significant experience building and managing investment firms from new funds to the world’s largest hedge fund.

Charles was COO at a division of Bridgewater Associates and at Point72 Ventures, with responsibility for business strategy, investment reviews, building new business lines, and recruiting and developing investment talent. He understands the process rigor required to operate a world class investment business and implement best practice decision-making.

Chloe is passionate about partnering with companies that make essential services—health, energy, infrastructure—more abundant, accessible and affordable.

Chloe studied alternative energy systems and development economics at Columbia. As an early team member at Oscar Health, she developed products that helped patients find better doctors and lower-cost care options. She later founded Uno Health, which enabled Medicare Advantage insurers to deliver prescription drug subsidies to low-income members—improving patient access while increasing plan revenues.